Mineral Resource estimates for two Ayawilca deposits have been updated as a result of nearly 12,000 metres of drilling completed in the past 18 months.

Key Highlights of the Updated Mineral Resource Estimates at Ayawilca:

- Indicated Zinc Zone Mineral Resource of 19.0 million tonnes grading 7.2% zinc, 0.2% lead and 16.8 g/t silver containing:

- 3.0 billion pounds of zinc;

- 10.3 million ounces of silver; and

- 87 million pounds of lead.

- Inferred Zinc Zone Mineral Resource of 47.9 million tonnes grading 5.4% zinc, 0.4% lead & 20.0 g/t silver containing:

- 5.7 billion pounds of zinc;

- 30.7 million ounces of silver; and

- 370 million pounds of lead.

- Inferred Tin Mineral Resource of 8.4 million tonnes grading 1.0% tin, containing:

- 189 million pounds of tin.

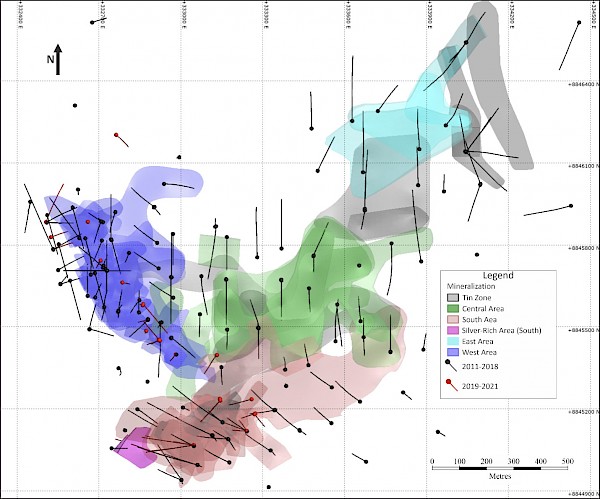

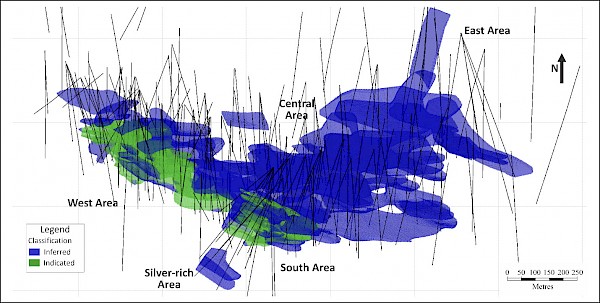

The Tin Zone and Zinc Zone resources do not overlap, with the Tin Zone situated predominantly beneath the Zinc Zone. The Mineral Resources are reported above a net smelter return (NSR) cut-off value of US$55/tonne for the Zinc Zone and US$60/tonne for the Tin Zone, as estimated by SLR Consulting (Canada) Ltd (SLR). A plan view showing all estimated Mineral Resources at Ayawilca is presented in Figure 1, and Indicated and Inferred Zinc Zone Mineral Resources are presented in Figure 2.

Dr. Graham Carman, Tinka’s President and CEO, stated:

“We are very pleased to report an updated mineral resource estimation for the Ayawilca Zinc and Tin Zones. A major step forward is the large increase in Indicated Zinc Zone resources to 3.0 billion pounds of contained zinc (previously 1.8 billion pounds), a 68% increase.

The Indicated Zinc Zone resource has remained at a high grade of 7.2% zinc (+ silver + lead), while the Indicated Mineral Resource category now constitutes 35% of the total zinc inventory (previously 24%) at Ayawilca.

New drilling also added resources to Inferred Mineral Resources that effectively replaced those resources upgraded to the Indicated category, with contained zinc in the Inferred category increasing 1% to 5.7 billion pounds zinc compared to the 2018 estimate.“

“In addition, the updated Tin Zone Mineral Resource is now at a substantially higher grade (1.0% Sn) compared to the previous resource (0.63% Sn) with the discovery of new high grade tin mineralization at South Ayawilca.“

“Tinka has been growing the Ayawilca Mineral Resources consistently since 2015, and we have taken great strides positioning it as one of the largest and highest grade undeveloped zinc dominant deposits in the Americas.

We look forward to completing and announcing results of an updated PEA for Ayawilca in the coming weeks. The Company’s work programs are fully funded for the foreseeable future, with C$13 million in cash and no debt as at the end of June 2021.”

Figure 1 – Ayawilca drill hole map highlighting updated Mineral Resource wireframes and 2019-2021 holes

Figure 2 – 3D image of Ayawilca Zinc Zone resource wireframes and resource classification

Detail of Mineral Resource Estimates

The updated Mineral Resource estimates for the Ayawilca Zinc Zone and Ayawilca Tin Zone, with an effective date of August 30, 2021, were prepared by SLR Consulting (Canada) Limited (SLR). Estimated Mineral Resources prepared by SLR used drill results available to February 28, 2021.

The Ayawilca deposit resource database includes 209 drill holes totalling 88,110 m of drilling. The Zinc Zone Mineral Resources are hosted as lenses and veins of semi-massive to massive sulphides (mostly sphalerite, pyrite, galena and pyrrhotite) and magnetite hosted by Pucará Group limestone of Mesozoic age beneath a flat-dipping sandstone 150 m to 200 m thick belonging to the Goyllar Group.

The Zinc Zone and Tin Zone Mineral Resources are reported separately as they host different metals and are spatially separated. The Mineral Resource estimates conform to Canadian Institute of Mining, Metallurgy and Petroleum Definition Standards for Mineral Resources and Mineral Reserves dated May 10, 2014 (CIM 2014 definitions).

Indicated Mineral Resources are estimated to total 19.0 Mt at average grades of 7.15% Zn, 16.8 g/t Ag, and 0.21 % Pb and Inferred Mineral Resources are reported at 47.9 Mt at average grades of 5.36% Zn, 20.0 g/t Ag, and 0.35% Pb. Mineral Resources within the Zinc Zone are reported at a US$55/t NSR cut-off value – Table 1.

Table 1: Ayawilca Zinc Zone Mineral Resources as of August 30, 2021

Tinka Resources Limited – Ayawilca Property

| Classification/ Zone |

Tonnage (Mt) |

NSR ($/t) |

Grade | Contained Metal | ||||||

| (% Zn) | (g/t Ag) | (% Pb) | (Mlb Zn) | (Moz Ag) | (Mlb Pb) | |||||

| Indicated | ||||||||||

| West | 11.6 | 108 | 6.26 | 15.9 | 0.25 | 1,607 | 6.0 | 65 | ||

| South | 7.3 | 145 | 8.56 | 18.3 | 0.13 | 1,383 | 4.3 | 22 | ||

| Total Indicated | 19.0 | 123 | 7.15 | 16.8 | 0.21 | 2,990 | 10.3 | 87 | ||

| Inferred | ||||||||||

| West | 5.5 | 106 | 5.90 | 20.8 | 0.42 | 719 | 3.7 | 52 | ||

| South | 9.0 | 134 | 7.45 | 34.4 | 0.33 | 1,477 | 10.0 | 65 | ||

| Central | 17.4 | 81 | 4.55 | 13.8 | 0.34 | 1,747 | 7.7 | 132 | ||

| East | 10.6 | 88 | 5.04 | 14.4 | 0.20 | 1,177 | 4.9 | 46 | ||

| Silver | 0.4 | 93 | 3.58 | 106.7 | 0.65 | 33 | 1.4 | 6 | ||

| Buffer | 4.9 | 87 | 4.66 | 19.2 | 0.63 | 504 | 3.0 | 69 | ||

| Total Inferred | 47.9 | 96 | 5.36 | 20.0 | 0.35 | 5,657 | 30.7 | 370 | ||

Notes:

- CIM (2014) definitions were followed for Mineral Resources.

- Mineral Resources are reported above a cut-off net smelter return (NSR) value of US$55/t.

- The requirement of a reasonable prospect of eventual economic extraction is met by having a minimum modelling width for mineralized zones of three metres, a cut-off based on reasonable input parameters, and continuity of mineralization consistent with a potential underground mining scenario.

- The NSR value was based on estimated metallurgical recoveries, assumed metal prices, and smelter terms, which include payable factors, treatment charges, penalties, and refining charges. Metal price assumptions were, US$1.20/lb Zn, US$22/oz Ag, and US$0.95/lb Pb. Metal recovery assumptions were, 92% Zn, 85% Ag, and 70% Pb. The NSR value for each block was calculated using the following NSR factors; US$16.23/% Zn, US$0.27/g Ag, and US$10.20/% Pb.

- Payability is as follows; Zn 84%, Pb 94% and Ag 47%

- The NSR value was calculated using the following formula:NSR = Zn(%)*US$16.23+Ag(g/t)*US$0.27+Pb(%)*US$10.20

- Numbers may not add due to rounding.

Indium was previously included in the Zinc Zone resource estimation but is no longer reported.

The Tin Zone Mineral Resources are hosted as disseminated cassiterite in massive to semi-massive pyrrhotite lenses typically (but not always) near the contact between the Pucara Group and underlying phyllite of the Devonian Excelsior Group.

Inferred Mineral Resources within the Tin Zone, reported at an NSR cut-off value of $60/t, are estimated to total 8.4 million tonnes at average grades of 1.02% Sn. Two different NSR factors for tin were used to estimate the Tin Zone resource depending on the ratio of Sn:Cu – a higher NSR was applied to mineralization with a higher Sn:Cu ratio. See Table 2.

Table 2: Ayawilca Tin Zone Inferred Mineral Resources as of August 30, 2021

Tinka Resources Limited – Ayawilca Property

| Classification | Tonnage (Mt) |

NSR ($/t) |

Grade (% Sn) |

Contained Metal (Mlb Sn) |

| Inferred | 8.4 | 103 | 1.02 | 189 |

Notes:

- CIM (2014) definitions were followed for Mineral Resources.

- Mineral Resources are reported above a cut-off grade NSR value of US$60/t.

- The requirement of a reasonable prospect of eventual economic extraction is met by having a minimum modelling width for mineralized zones of three metres, a cut-off based on reasonable input parameters, and continuity of mineralization consistent with a potential underground mining scenario.

- The NSR value was based on estimated metallurgical recoveries, assumed metal prices, and smelter terms, which include payable factors, treatment charges, penalties, and refining charges. Metal price assumptions were, US$11.00/lb Sn. Metal recovery assumptions were, 70% Sn for blocks with Sn:Cu ≥ 5 and 40% for Sn:Cu < 5. The NSR value for each block was calculated using the following NSR factors, US$141.64 per % Sn for blocks with Sn:Cu ≥ 5 and US$80.94 for blocks with Sn:Cu <5.

- The NSR value was calculated using the following formulae:

If Sn:Cu ≥ 5: US$NSR = Sn(%)*US$141.64

If Sn:Cu < 5: US$NSR = Sn(%)*US$80.94 - Numbers may not add due to rounding.

Copper and silver were reported in the Tin Zone previously but are no longer reported because they are not expected to contribute materially to the economics of the project.

Depending on the deposit area, high grade tin and silver values were capped to 4% Sn and 100 g/t Ag to 175 g/t Ag. Assays within the wireframe domains were composited to two metre lengths. Block model grades within the wireframe models were interpolated by the inverse distance cubed (ID3) method.

While lead grades are low, it is assumed that lead and silver will be recovered in a lead concentrate. Density was estimated to be 3.5 t/m3 and 3.7 t/m3 for the Ayawilca Zinc Zone and 3.9 t/m3 for the Ayawilca Tin Zone based on density measurements of typical mineralization from each zone.

The Buffer Zone area outside the resource wireframes was assigned a density value of 3.5 t/m3. The Mineral Resources were assigned Indicated and Inferred category in the Ayawilca Zinc Zone and Inferred only in the Ayawilca Tin Zone due to the widely spaced drilling.

The drill hole spacing within the area assigned as Indicated category commonly ranges from 40 m to 70 m. No Mineral Reserves have yet been estimated at Ayawilca.

The Mineral Resource estimate for the Colquipucro silver oxide deposit (also referred to as “Colqui”), located 1.5 km from the Ayawilca deposit, remains unchanged since the 2016 effective date and is presented in Table 3.

Table 3: Colquipucro Silver Oxide Deposit Mineral Resources as of May 25, 2016

Tinka Resources Limited – Ayawilca Property

| Classification/Zone | Tonnage (Mt) |

Grade (g/t Ag) |

Contained Metal (Moz Ag) |

| Indicated | |||

| High Grade Lenses | 2.9 | 112 | 10.4 |

| Low Grade Halo | 4.5 | 27 | 3.9 |

| Total Indicated | 7.4 | 60 | 14.3 |

| Inferred | |||

| High Grade Lenses | 2.2 | 105 | 7.5 |

| Low Grade Halo | 6.2 | 28 | 5.7 |

| Total Inferred | 8.5 | 48 | 13.2 |

Notes:

- CIM (2014) definitions were followed for Mineral Resources.

- Mineral Resources are reported within a preliminary pit shell and above a cut-off grade of 15 g/t Ag for the low grade halo and 60 g/t Ag for the high grade lenses.

- The cut-off grade is based on a price of US$24/oz Ag.

- Numbers may not add due to rounding.

Discussion and Analysis

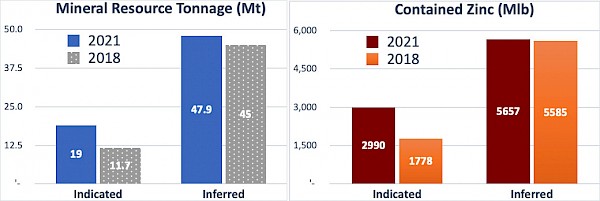

A comparison of the 2021 and 2018 Zinc Zone resources at US$55/t cut off is highlighted graphically in Figure 3. The increase in Indicated Resources in the 2021 resource estimation is due to discovery of new mineralization as well as a significant increase in the understanding of the litho-structural setting, following the completion of 11,633 metres of diamond drilling between 2019 to 2021.

Figure 3 – Ayawilca Zinc Zone deposit classification model

The geological model and wireframes for the updated model were produced in-house by Tinka. SLR refined the resource domains to align with the stratigraphy and limited their extent to the Pucará and Lower and Mid-Goyllar Formations.

Similarly, the domains were constrained by the faults that are known to limit the mineralization. The new geological model, improved mineralization domains, as well as the new infill drilling led to an increase in resources assigned to the Indicated category.

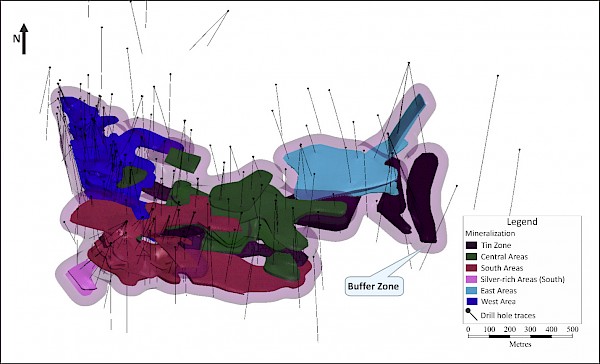

SLR constructed a buffer zone to allow interpolation in a limited area of 50 m surrounding the mineralization wireframe models. The Buffer Zone captures local high grade mineralization, in particular post-main stage zinc mineralization for which controls are not yet well constrained, and is highlighted in Figure 4.

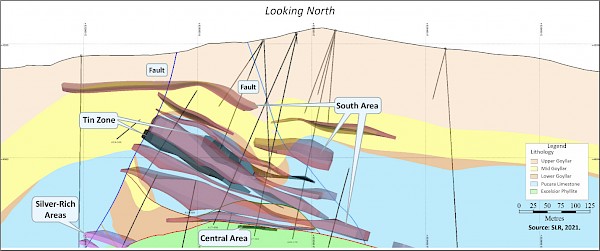

A generalized layout of the Zinc Zones at South Ayawilca is shown in Figure 5.

Increased average grades of lead and silver in the Ayawilca Zinc Zone resource are due to the inclusion of new resource areas higher in lead and silver (i.e., silver rich domains in the South Area) but low in zinc. These new areas are now included in the resource estimate due to higher NSR factors for both lead and zinc.

The removal of indium from the 2018 NSR value calculation for the Ayawilca Zinc Zone has slightly improved the average zinc grade by narrowing the resource wireframes to better represent the zinc mineralization. In addition, although the NSR cut-off value is the same as in 2018 (US$55/t), the NSR factors for each metal used to calculate the value of a block have all increased.

While the mineralization domains were expanded for the Ayawilca Tin Zone in the current estimation, there was nevertheless a decrease in tonnage from the 2018 resource estimation. The decrease in tonnage was accompanied by a significant increase in tin grade. The increase in average tin grade is due to several factors including:

- The discovery of new high grade tin mineralization in 2020 and 2021;

- A higher effective NSR cut-off value applied to the Mineral Resource (US$60/t);

- The removal of copper and silver mineralization from NSR value; and

- A decrease in the tin factor in the NSR value calculation.

A National Instrument 43-101 Technical Report will be filed on SEDAR within 45 days.

Figure 4 – 3D view of Ayawilca Zinc Zone wireframes

Figure 5 – Generalized E-W cross section of Zinc Zones at South Ayawilca

Qualified Person – Mineral Resources: The Mineral Resources disclosed in this press release have been estimated by Ms. Dorota El Rassi, P.Eng., SLR Consultant Engineer and Ms. Katharine M. Masun, MSA, M.Sc., P.Geo., SLR Consultant Geologist, both independent of Tinka. By virtue of their education and relevant experience, Ms. El Rassi and Ms. Masun are “Qualified Persons” for the purpose of National Instrument 43-101. The Mineral Resources have been classified in accordance with CIM Definition Standards for Mineral Resources and Mineral Reserves (May, 2014). Ms. El Rassi and Ms. Masun have read and approved the contents of this press release as it pertains to the disclosed Mineral Resource estimates.

The Qualified Person, Dr. Graham Carman, Tinka’s President and CEO, and a Fellow of the Australasian Institute of Mining and Metallurgy, has reviewed and verified the technical contents of this release.

___

For more news and information from Mining News Network, subscribe to our free email newsletter.

___

Disclaimer: As a result of the new resource estimation, the Company’s previously disclosed preliminary economic assessment on the Ayawilca project is no longer current and should not be relied on. The Company has commissioned an updated PEA on the Ayawilca project based on the new resource estimate and upon receipt of the updated PEA (expected in approximately 2 weeks), the Company intends to issue a news release disclosing the results of the PEA.

| On behalf of the Board,

“Graham Carman” |

Further Information: www.tinkaresources.com Mariana Bermudez 1.604.685.9136 info@tinkaresources.com |